Gene Roddenberry had a dream. He invented a universe where humans had eliminated disease, poverty, war, bigotry, and greed by banding together to seek out new life and to boldly go where no man had gone before. Sound familiar? It should. Unfortunately for us, that day is a long ways off. We live in a society where money does most of the talking, where absolute power corrupts absolutely, where the rich get richer and the poor get poorer. It’s important in today’s society to ensure you have good credit in case of emergencies, yet the reality is that some people either don’t care about their credit or don’t know how to repair the damage that they may have done to it. If you think that not all companies know or can find out about your financial history, then you’re not living in the twenty-first century.

In the Final Frontier, even dogs know when you have poor credit.

Having good credit is important for a couple of reasons. Let’s say that sometime down the line you want to buy/rent a house, an appliance, or furniture. Perhaps you are moving and need to open up an account with your local gas or light company. Most of the time, you’ll be asked for permission for them to run a credit report on you to see what options are available to you. If your credit score comes back and is under their recommended range, you will most likely be given one or two options to choose from and one of those options include finding another company to deal with. Oh sure, some of those companies may take you anyway but not without you putting down a sizable security deposit or down payment. Those six/twelve month same as cash deals you see advertised are often reserved for people with good credit and with good reason. A note about those deals, some same as cash loans inflate their original price to include interest. Always check first before you lock yourself into one.

Did you know that there are some companies who run these kinds of background checks on possible / current employees? Maybe the job you are applying for wants to check on your financial status. If you were the employer, would you hire someone who has a history of not living up to their agreements?

We’d like to hire you, though it turns out you owe our company a few million dollars.

How does one get good credit? If you’ve paid every bill you have ever owed on time and for the amount due, chances are you have exceptional credit. If one of those bills is to pay off a credit card, car loan, or mortgage, all the better. Paying popular financial institutions on time goes a long way to boosting your credit score. Missing a bill here or there will not hurt your credit score, but most people who have exceptional credit have learned the most important aspect of banking…never spend more than what you have. People with great credit know how to manage their money, even if they are only making twenty thousand a year. You don’t have to be rich to establish good credit.

If you’re young and new to the credit scene, it’s not as complicated as it sounds. Pay your bills on time and when you’re given the choice to buy a pack of death sticks or to pay your light bill, always go with the latter. Having good credit also means being in control of your spending habits. I’ve come across many people who have made the mistake of splurging on their new-found freedoms when they were in their early twenties by racking up credit card bills faster than they could keep up with them. What started as a credit purchase for a Hello Kitty window decal turned into something a lot more serious. The trick is to train yourself only to use your card once in a blue moon and to pay it off immediately before interest can accumulate. By paying off your bill quickly, you’re not only building credit, but you’re not losing out on monies from interest in the process. Doing this over a long period of time will aid you in bringing your credit score up.

There are some things you’ll purchase via credit you’ll later come to regret, in more ways than one.

Train yourself not to spend money on things you want when you don’t have the money for the things you need. It’s tempting to swipe that credit card for the things you want chalking it up to you working hard and being deserving of a reward. This is fine…IF you can pay if off quickly. A ten-dollar item with interest over many months can easily turn into a twenty-dollar bottom line figure. Building your credit does not mean having to make poor decisions or putting yourself in the poorhouse to do it.

Another way to keep your credit score up is to not open a billion different cards. Every retail store you go to will try to get you to open one of their cards and save ten percent on their next purchase or something silly like that. You may think that is a good deal, but most people who open those cards don’t pay off their purchase right away and the interest you shell out turns out to be more than the ten percent you saved in your original purchase. The interest rate on those cards are generally higher as well. Open one, maybe two cards and that’s it. Keeping too many lines of credit open looks bad on your credit report. On those one or two cards, make sure there is no annual fee and try to make sure you can get a good deal on the interest rate. Keep your purchases on those cards small and pay them off quickly.

You’ll have one for every store unless you learn to say no.

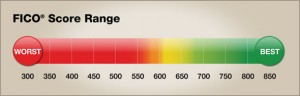

Keeping your credit in check via a free yearly credit report is also a wise move. It’s important to see what kind of activity is on them so you can dispute anything that is incorrect. This may also help you spot possible identity theft. Most companies who run credit checks on you send you a letter saying you are entitled to a free copy of that credit report, especially if they deny you said credit. By all means, take the five minutes to fill out the form (be sure you recognize the company and why they ran one on you in the first place) and send it in. If a letter looks suspicious and asks for a lot of personal information, you should not do it. Please note that most of these free reports will NOT include your credit score, but it’s still good to know what your credit report looks like regardless. In the case you are able to get a free report with your score on it, you’ll want to aim for 620 or above. If possible, stay above 700.

Red…Red is bad mmmmmkay?

To quickly recap, pay your bills on time, keep low balances to avoid high interest payments, avoid opening many lines of credit, and train yourself not to splurge when you don’t have the money. Doing all of these things will help restore or boost your credit. Don’t expect results overnight, but it can be done. Do yourself a favor and take a look at your credit, you owe it to yourself to ensure that when the time comes when you really do need it, you’ll get it.

So, the next time Nappa from Dragonball Z asks Vegeta what the scouter says about your credit score, he should hopefully be able to answer in a positive manner.

Vegeta is clearly happy about your credit score.